Case Studies

Payment Gateway

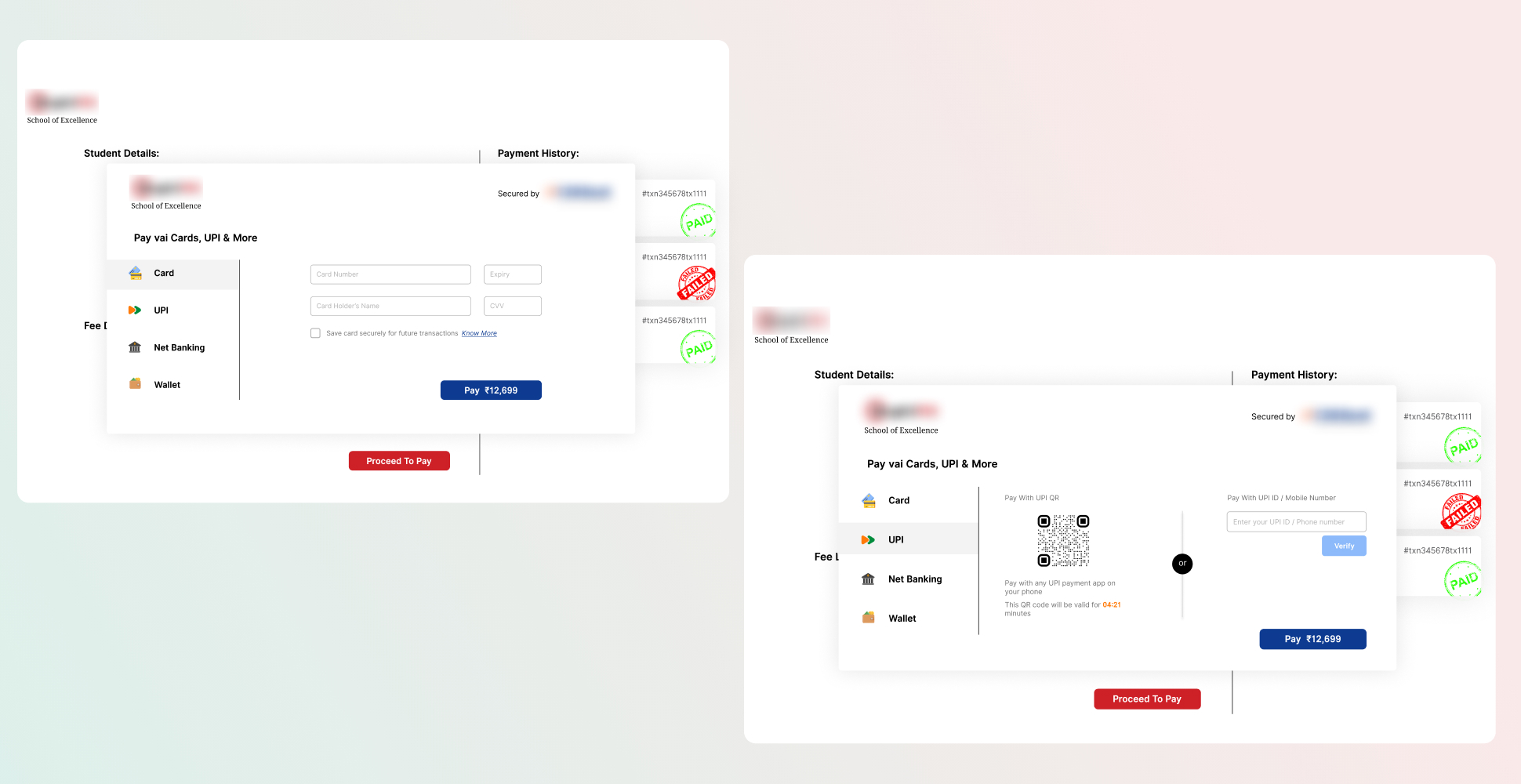

UX, UITo design a payment gateway to be offered as a Software-as-a-Service (SaaS) product for banks, incorporating essential features from existing aggregators while optimizing usability and user experience.

Challenges

Market Saturation: The payment gateway market is highly saturated with numerous well-established players. The challenge was to design a product that stands out by offering an improved user experience without overwhelming users with unnecessary complexity.

User-Centric Design: The goal was to create a gateway that is intuitive and user-friendly, catering to a broad audience that includes both tech-savvy users and those less familiar with online payments.

Security and Trust: Ensuring that the design instills a sense of security and trust among users, as payment gateways handle sensitive financial information.

Research and Discovery

1. Secondary Research:

Competitive Analysis: Conducted an extensive review of existing payment gateways to understand their strengths, weaknesses, and unique selling points. This analysis included a deep dive into the user flows, visual design, security features, and pain points experienced by users across different platforms.

Feature Benchmarking: Identified key features that users value most in a payment gateway, such as quick transaction processing, minimal steps for payment completion, clear error messages, and robust security measures. This benchmarking helped in determining the must-have features for the new gateway.

2. User Behavior Analysis:

Usability Studies: Analyzed user behavior on existing payment gateways to identify common friction points, such as confusing navigation, lengthy checkout processes, and lack of transparency in transaction fees. This analysis provided valuable insights into areas where improvements could be made.

3. Problem Statement:

The existing payment gateways, while feature-rich, often compromise user experience by adding unnecessary complexity. The challenge was to create a gateway that is both feature-complete and easy to use, ensuring a seamless transaction experience for all users.

Design Approach

1. Ideation and Conceptualization:

Simplicity at the Core: The design process was driven by the principle of simplicity. The focus was on streamlining the user journey, reducing the number of steps required to complete a transaction, and ensuring that users can navigate the gateway effortlessly.

Preserving Best Features: Integrated the most user-friendly and essential features identified during the research phase, such as one-click payments, automatic error correction, and real-time transaction tracking. These features were carefully selected to enhance usability without overwhelming the user.

2. UX Design:

User Flow Optimization: Redesigned the user flow to minimize friction points. For example, the checkout process was condensed into a few clear, straightforward steps, and unnecessary distractions were removed from the interface. Each step was designed to be intuitive, guiding the user seamlessly from payment initiation to confirmation.

Trust-Building Elements: Incorporated trust signals throughout the user journey, such as visible security badges, clear communication of transaction status, and transparent fee structures. These elements were critical in reassuring users about the safety and reliability of the gateway.

3. UI Design:

Clean and Minimalist Interface: Developed a clean, minimalist interface that prioritizes ease of use. The design uses a neutral color palette and clear typography to ensure that users can easily find and understand the information they need.

Responsive Design: Ensured that the gateway is fully responsive, providing a consistent experience across desktop, tablet, and mobile devices. The responsive design also allows for easy integration with different banking platforms.

4. Feature Integration:

Simplified Navigation: Designed a navigation structure that allows users to easily access the most critical features, such as payment history, saved payment methods, and support. This structure was designed to reduce cognitive load and make the gateway as intuitive as possible.

Error Handling and Feedback: Developed a robust error-handling system that provides clear, actionable feedback to users in case of transaction issues. This system was designed to prevent user frustration and increase overall satisfaction with the gateway.

Outcome and Impact

1. User Adoption and Satisfaction:

Positive Feedback: The payment gateway was well-received by users, with high satisfaction scores for its ease of use and streamlined transaction process. Users particularly appreciated the simplified checkout process and the clear communication of transaction status.

Increased Conversion Rates: Banks that adopted the gateway reported an increase in successful transaction rates and a reduction in user drop-off during the payment process, indicating a strong positive impact on user experience.

2. Business Impact:

Competitive Edge: The gateway’s user-centric design provided banks with a competitive edge in the market, allowing them to offer a payment solution that was not only secure and feature-rich but also superior in terms of user experience.

Scalability: The modular design approach allowed the gateway to be easily scaled and customized for different banking platforms, making it a versatile solution that could be adapted to various use cases.

3. Long-Term Success:

Industry Recognition: The gateway’s design approach was recognized as a best practice in the industry, setting a new standard for how payment gateways can combine comprehensive functionality with exceptional usability.

Key Takeaways

This project underscored the importance of simplicity in design, especially in a crowded and competitive market like payment gateways. By focusing on user needs and leveraging the best features from existing solutions, we were able to create a product that not only met but exceeded expectations, resulting in a highly competitive and successful SaaS offering for banks.